The Harwood Unified Union School District Board continues its budget work for FY2026 and current estimates have education taxes dropping for all district towns except Fayston.

Local taxpayers will be seeing projected education tax decreases that range from $651 for a $350,000 house in Duxbury to $26 for a similar house in Warren. In Fayston a $350,000 house will see a $751 education tax increase.

While the district’s proposed budget for the coming fiscal year is lean – just 2% year over year – which is achieved by cutting 16-20 positions. But that alone is not what is causing five of the six district towns to see education tax decreases/increases.

What is driving those is the state’s formula for determining each town’s Common

Level of Appraisal (CLA) and the town-by-town tax rates that yields. In the HUUSD those tax rates range from $2.259 in Fayston to a low of $1.188 in Moretown. Moretown completed a town reassessment last year which re-sets its education costs and results in a CLA greater than 100%.

WHY FAYSTON?

So why is Fayston such an outlier this year? Last year Fayston’s post CLA tax rate was $2.044 which means it jumped 21 cents for this tax rate. It is that jump that is leading to Fayston’s tax increases this year. The tax rate changes for other towns in the district all went down, with decreases ranging from $0.19 in Duxbury to $0.12 in Moretown to $0.01 in Warren, Waitsfield and Waterbury.

What impacts those tax rate increases or decreases? The CLA. CLAs reflect the difference between how a town has properties valued and what the state estimates would be 100% of full, fair market value.

Let’s take a look at CLAs last year and this year.

Here are last year’s CLAs

- Duxbury 68.43%.

- Fayston 71.91%.

- Moretown 110.57% (reassessed).

- Waitsfield 66.85%.

- Warren 61.30%.

- Waterbury 66.07%.

And here are the state calculations for CLAs for the 2026 budget year before the state added a multiplier to all CLAs in the state that increased them without significantly impacting tax bills.

Pre-state multiplier

- Duxbury 63.96%.

- Fayston 54.79%.

- Moretown 103.75% (reassessed).

- Waitsfield 57.31%.

- Warren 52.43%.

- Waterbury 56.62%.

Post-state multiplier

- Duxbury 88.39%.

- Fayston 75.72%.

- Moretown 143.98%.

- Waitsfield 79.20%.

- Warren 72.46%.

- Waterbury 75.72%.

OUTPACING OTHER TOWNS

At first glance, Fayston’s CLA numbers don’t appear too off from other district towns, but the change in actual CLA from last year to this year, 71.01 to 54.79% reflects continued upward real estate sale prices that are outpacing those in other towns. Even though other district towns have CLAs that are lower or almost as low both before and after the state’s required tinkering with the numbers, Fayston taxpayers will be facing a 10% increase in education taxes this year, after the 14% increase last year.

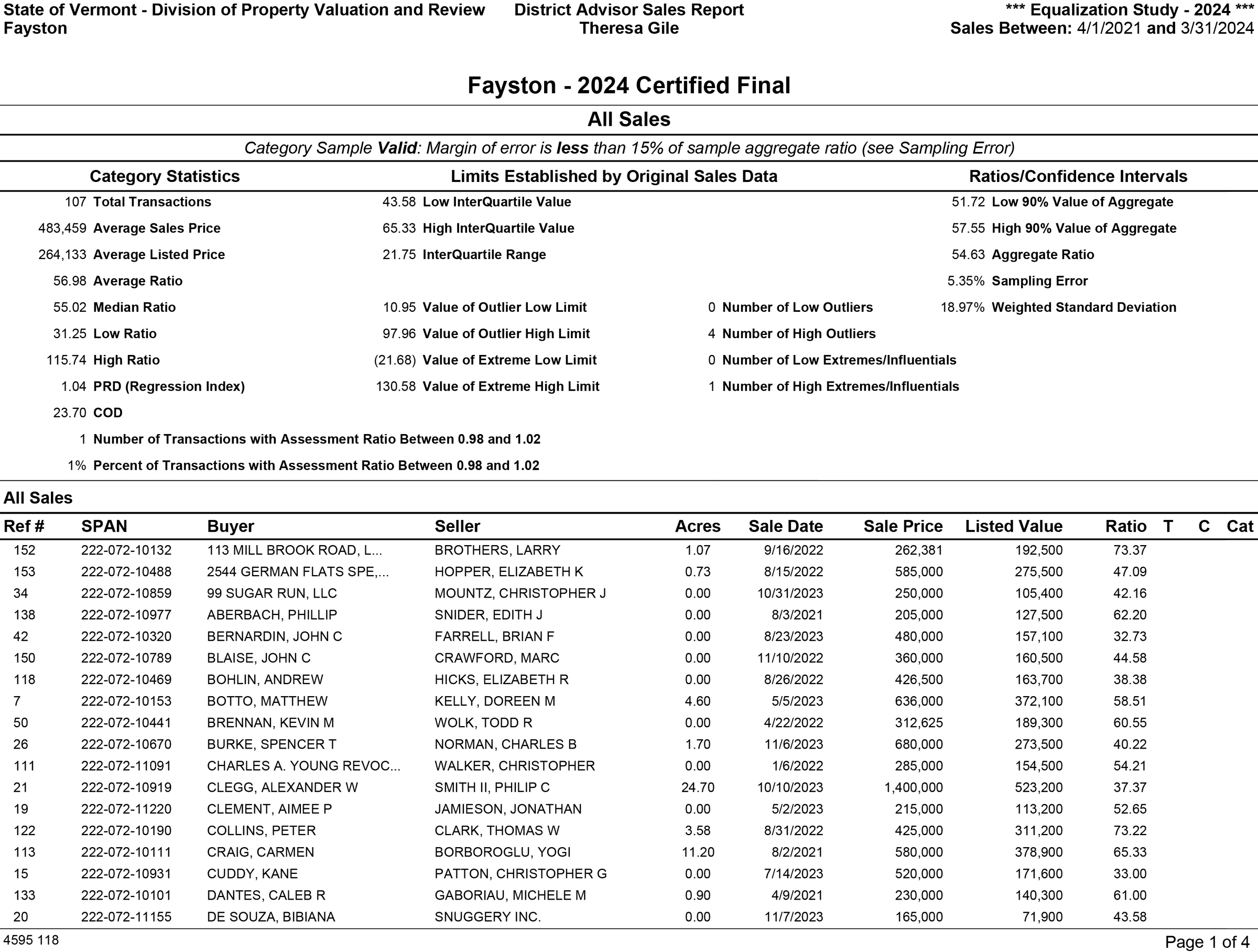

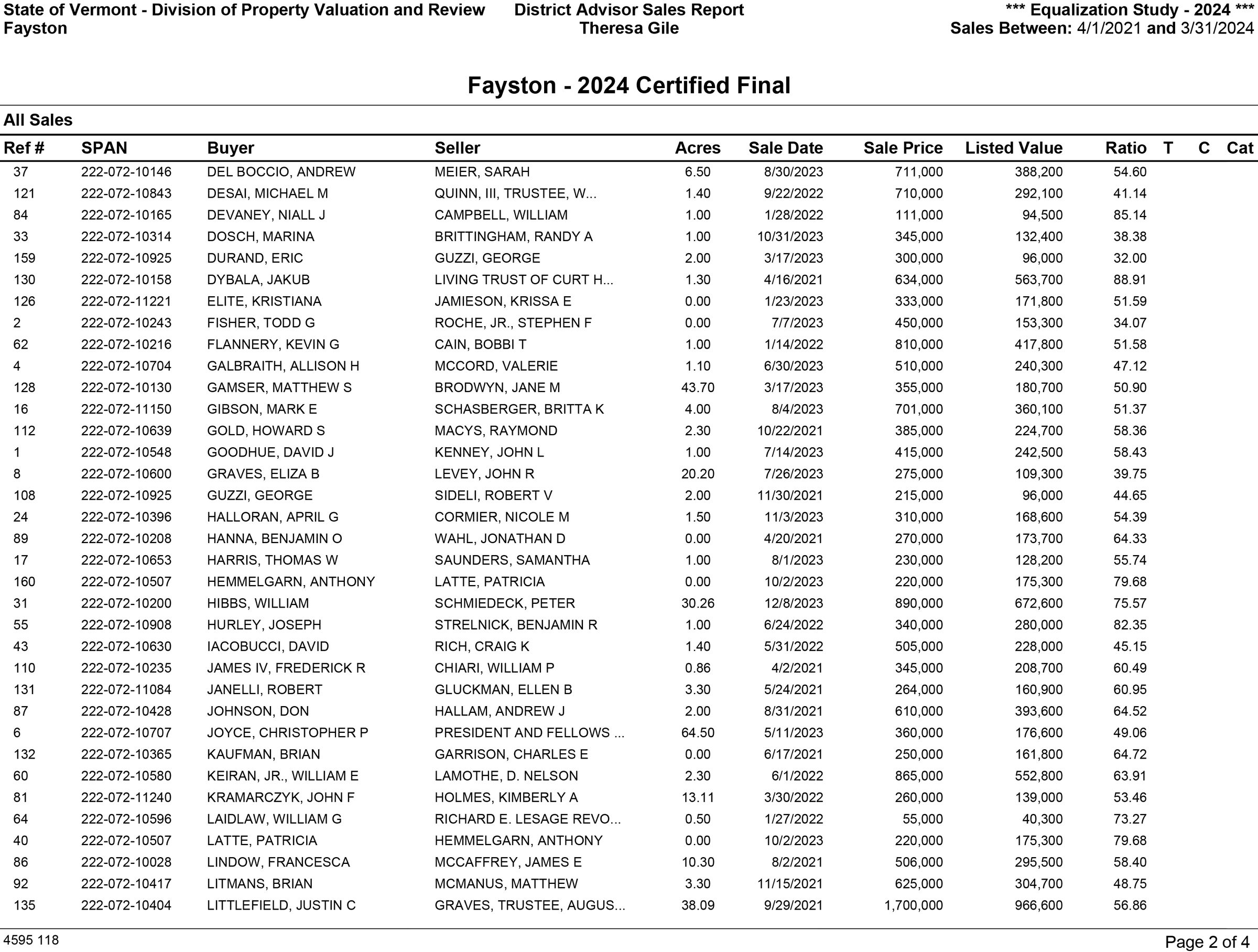

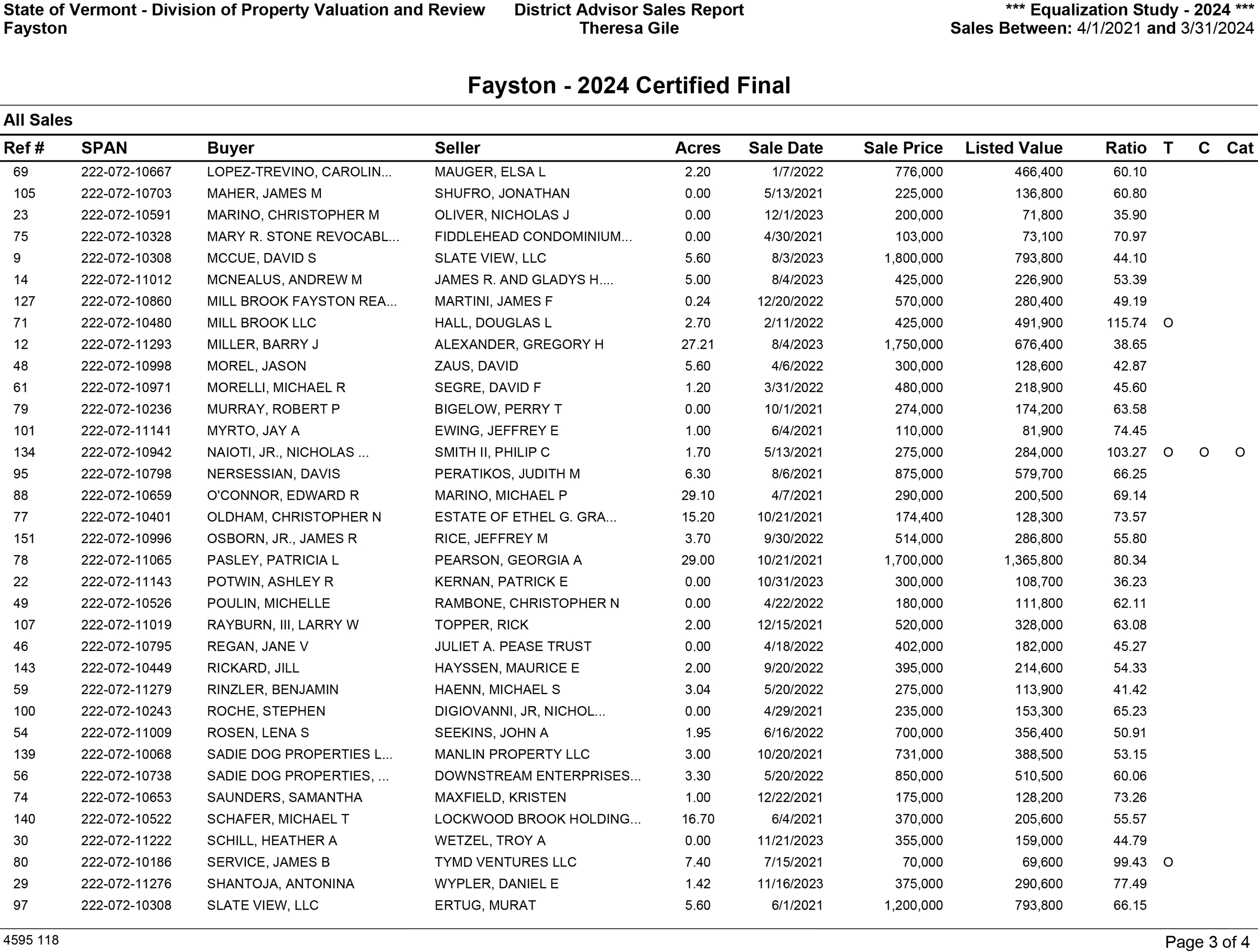

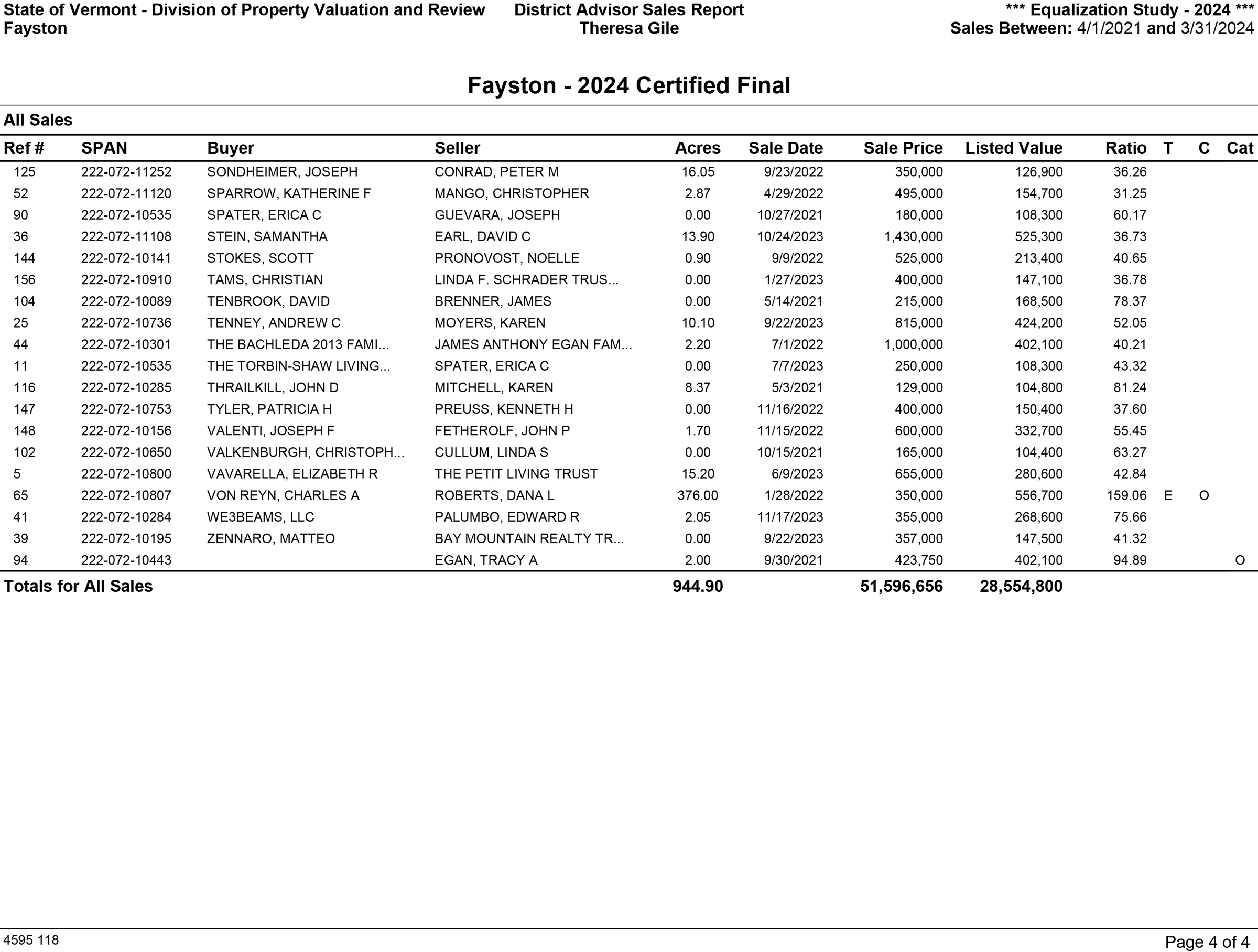

What is it about Fayston’s real estate sales that is driving its CLA down so much? Fayston’s lead lister Doug Mosle shared a list of real estate sales that the state used to determine the town’s CLA. The state uses three years of sales, dropping off older sales as they age out. The current equalization period includes sales from April 1, 2021, through March 31, 2024.

In Fayston this represented 107 transactions. To understand how pervasive the upward pressure on prices is, note that the average sale price for those transactions was $483,459 compared to the average town assessed value of $264,133.

TWO FIGURES

To calculate a town’s CLA the state uses two figures, the town’s current Grand List which is called the Education Grand List (EGL) and an Equalized Education Grand List (EEGL) which is what the state calculates the town’s Grand List to be based on three years of actual sales.

Each year the state sends every town its Equalization Study Results which spells out its CLA and estimated Grand List at 100% of fair market value.

The January 2024 letter for Fayston showed an EGL of $387,662,410 and an EEGL of $545,909,039. Fayston’s January 2025 letter shows an EGL of $393,183,420 and an EEGL of $717,626,931.

To put that in perspective compared to Warren which might be The Valley’s most property wealthy town, the January 2024 letter for Warren showed an EGL of $766,899,938 and an EEGL of $1,250,987,323. Warren’s January 2025 letter shows an EGL of $776,582,838 and an EEGL of $1,481,252,622.

STATE ALGEBRA

Fayston’s lead lister, Mosle, provided details on each of the 107 transactions that went into this year’s CLA and even without doing the state’s algebra; it’s easy to see many transactions that demonstrate the upward trend in real estate sales prices.

A 24.7-acre parcel with a dwelling sold in Fayston in October 2023 for $1,400,000. It was assessed by the town for $523,200. A 38-acre parcel with a dwelling sold for $1,700,000 in September 2021. It was assessed at $966,600. Those are some of the higher dollar transactions. There were quite a few properties values in the $230,000-$480,000 range that sold in the $500,000 to $700,000 range as well.

Here is a link to that document: FAYSTON REAL ESTATE SALES APRIL 2021 TO MARCH 2024

Here are those slides as images (click to enlarge):

That’s a lot of numbers to take in and the school board is still fine-tuning this year’s expenses and cuts. The board expects to have final budget numbers after its January 22 meeting.