Editor’s Note: In advance of next week’s budget revote, the Harwood Unified Union School District Board has created this Q and A to help voters understand the budget.

Revised budget vote for May 30

- $47,892,873 Revised School Budget

- $2,951,830M Reduction in total expenditures

- 5 Staff positions have been cut

- $1,682,300 cut in operational costs

How much is the proposed revised May 30 budget and what is increasing over the current year?

The latest budget has total expenditures of $47,892,873, which represents a total education spending increase of 5.4%. This equates to only a slight increase of .09% to HUUSD per pupil spending as calculated by the state’s formula.

This budget represents the district’s best effort at continuing to provide the high-quality education taxpayers expect from HUUSD despite numerous external forces bearing down on the district. These include statewide and national healthcare increases, inflation, increased special educational expenses, and a tight labor market.

How does this impact our children?

This new budget will eliminate the world language program in all of our elementary schools, and will reduce interventionists support (literacy, math, and behavior) throughout all our schools.

What happens if the budget fails again?

The board will develop a new revised budget and keep going out to vote until we have a passed budget.

If this next budget doesn’t pass, what would be the next round of reductions?

Additional cuts would have to be considered in staffing and programming. Core education would be prioritized. Here are the next round of possible cuts:

- Athletic programs could be eliminated

- Co-curricular activities such as theater productions and student clubs

- Additional programs and positions, similar to elementary world language in the third vote, that are outside of the bare minimum state-required services will need to be reduced

What if you don’t have a budget passed by July 1, 2024?

If the budget does not pass before July 1st, the district is permitted to borrow up to 87% of the current year’s budget until a voter approved budget is passed. This does not mean we operate at 87% for FY25.

What criteria was used by the Board in discussing reductions?

- Maintain Support for HUUSD’s Mission and Vision

- The district desires to preserve student-facing positions which ensure direct support for students and educational needs. Emphasis was placed on supporting required core academic programming while maintaining a conducive learning environment.

What are the HUUSD Board’s budget goals?

The Board used these budget goals when considering a revised budget for the April 30 & May 30th votes:

- Reduce tax impacts based on March 5th vote and community feedback

- Focus on reductions that minimize the impact on students

- Reduction of HUUSD cost per pupil

Does it cost money each time you go out and vote?

Yes, not only does the district incur costs but the towns incur additional costs as well. Advertising the warnings, printing the ballots and flyers, mailing the flyers, and running the elections all have associated costs.

Does it cost taxpayers money when the school district borrows money to fund the school budget?

Yes, there are administrative fees and interest payments that the district will incur depending on the length of the loan. Since this is a short term loan until a budget is approved by the voters, the terms of the loan would most likely involve high interest rates.

What other reductions would make the budget more affordable?

There are no practical cuts. District needs are significant as we continue to grapple with ongoing pandemic-related needs and fixed costs. It is required that districts maintain essential positions, course offerings, and programs. The Board has control of limited elements within the budget such as non-required courses, special programming, athletics/sports, student co-curricular activities, field trips, transportation, student clubs, extended learning opportunities. All expense categories will be reviewed to find cost saving measures and efficiencies.

What other factors are impacting the budget this year?

Factors contributing to the budget increase are:

- Loss of COVID/ESSER funding

- A 16.4% increase in the cost of health insurance. Background information on the rate filing can be found here.

- Note: health insurance for school employees is negotiated at the state level, not the district level. It is not something the Board has the power to change. For more details, see the Vermont Employee Health Insurance (VEHI) website at https://vehi.org/

- Negotiated salaries

- Increase in special educational costs

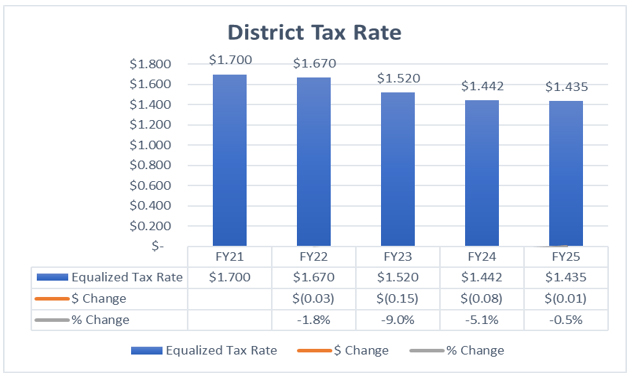

How does the district Tax Rate compare to FY24 and past years ?

What is Common Level of Appraisal (CLA)?

The term is also known as common level of assessment. The common level of appraisal ensures that you and your neighbor in the next town pay a reasonable comparable education tax on properties of equal value. The CLA is used to equalize education taxes statewide by reflecting local variations that occur based on reappraisal schedules and other factors. It is useful to think of the CLA as adjusting the listed value of a property to fair market value to ensure fairness.

The CLA for every Vermont town is the primary result of the Equalization Study performed by the Vermont Tax Department every year. The equalization study compares the ratio of the grand list listed value to the sale price for all the arms-length sales in the town over the prior three-year period. The study considers sales price as the best measurement of fair market value.

Once the CLA is determined, it is used to adjust the homestead and non-homestead tax rates. The CLA doesn’t change taxpayers’ property values, only the education tax rate in a town.

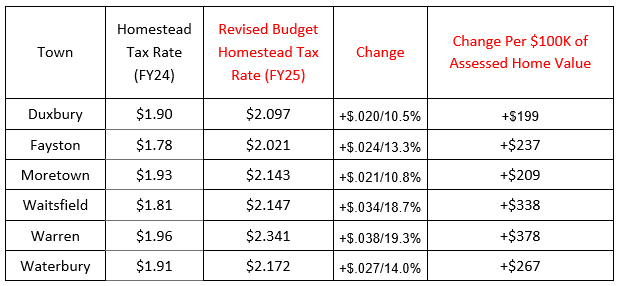

Given the decrease in CLAs, what are the implications for this budget on local taxes?

How would taxes be affected if you had a zero increase in spending?

Even if we would have a zero percent increase in our budget, each town will still see an increase to their homestead taxes of 3.3% to 11.5%.

What costs does the Board have control over?

The Board only has control over school spending and the district tax rate. The Board has no control over the towns’ homestead tax rate once the towns’ Common Level of Appraisal (CLA)

is applied.

Why are we not considering consolidation and closing schools?

The board needs more time and thought to do this carefully in light of the requirements in the 2017 articles of agreement for district unification which can be found here.

How will the district decrease per pupil cost?

We have formed a Finance Committee to do a deep dive into all line item expenses. The Board is committed to reducing the district's cost per pupil over the next several years.

The Board has charged the Finance Committee to strategize how to significantly reduce our expenditures and improve efficiencies without compromising our mission. The Board will seek to minimize the impact for students and will continue to partner with our communities to achieve our vision for excellence.

What is ACT 127?

An act relating to improving student equity by adjusting the school funding formally and providing education quality and funding oversight.

What are the impacts of ACT 127 on our budget and taxes?

In Vermont's education funding system, the state education fund, totaling around $2 billion, funds public school budgets. Local districts determine their budgets, and the spending per student influences local property tax rates. Act 127 allows districts with higher proportions of English language learners or low-income students to raise more funds, easing local tax rates. Conversely, wealthier, less rural districts may experience decreased weights, leading to potential tax rate increases. Here in HUUSD, we were negatively impacted by this new act.

After a recent modification, a portion of this law was modified in H850. The new law imposes a taxing capacity discount for schools experiencing the most significant losses in weighted pupils gradually reducing over the next five years. Each district receiving a rate discount will receive a $.01 reduction in their pre-CLA district tax rate for each percentage damage. For example, if a district was negatively impacted by 10% they will receive a $.10 rate discount in FY25.

Is the District receiving a taxing capacity discount?

The HUUSD will benefit from a $0.09 discount to our tax rate in fiscal year 2024-2025. This reduction will be reduced by 20% over the next five years, before going away completely.

Why are the negotiated salary increases projected to be so high?

The negotiated wage increases were a proactive measure taken by the school district to address the challenges posed by the tight labor market, align with regional wage standards, and ensure the recruitment and retention of skilled educators and support staff who play a crucial role in the education system, particularly during these trying times.

The agreements for support staff were settled at a slightly higher rate of increase due to several factors. Firstly, it's important to consider the context of the tight labor market, especially exacerbated by the challenges posed by the COVID-19 pandemic. The pandemic has highlighted the essential role of educators and support staff, making it imperative to offer competitive wages to attract and retain talent. Additionally, the wage increases were necessary to align with the wages paid in the rest of Washington County. Discrepancies in wages could lead to difficulties in attracting and retaining qualified staff, particularly in a competitive job market.

By offering higher wages, the school district aimed to remain competitive and ensure that its employees were fairly compensated for their hard work, especially considering the demanding nature of their jobs, which have become even more challenging due to the pandemic.

What can we do to advocate for positive change?

The School Board encourages everyone to vote and support our children and schools. A “no” vote will only negatively impact our community more.

Why shouldn’t I continue sending a message to legislators that they need to revamp the educational funding formula by voting “no” on the school budget?

Please consider writing letters and emails to your local legislators, asking them to address and revise the education finance system to ensure communities receive adequate funding at an affordable rate. However, this is not an overnight fix and any change will take time. A budget needs to be approved by the voters in order for the school district to operate.

The school district must have an approved budget. Voting “No” on the budget to send a message to the legislators is only delaying the process. With another failed budget, workforce (positions) and/or programming will be further cut. Each failed budget will also incur additional expenses for another public vote.

What can I do to support the community and the school district?

Encourage everyone to be informed and vote.

What is homestead vs non-homestead tax rates?

Only the homestead property tax rate is affected by local school board spending. The non-homestead rate is set at the statewide level and not locally adjusted by the school district spending.

How can I obtain more information on the budget?

Please visit huusd.org/budget-vote-may-30. You may also call or email Lisa Estler, Director of Finance & Operations, with any questions via her email at

When is the next informational meeting?

An informational budget meeting will be held on Monday, May 20, 2024 at 6:00 PM

at Harwood Union High School and via Zoom.

To participate remotely via Zoom, use this link: https://us02web.zoom.us/j/386460007

To view live broadcast, use this link: tinyurl.com/huwebapp-youtube-live.