The last chance for voters to ask questions about and comment on the $48,888,319 budget that comes before voters on April 30 is tonight, via Zoom at 6:00 p.m. The link for that meeting can be found at huusd.org,

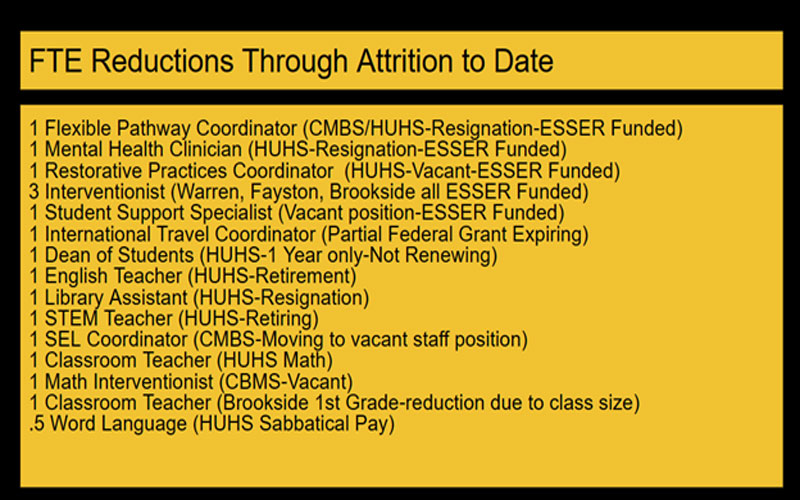

On April 30, voters in the six towns in the school district will head to the polls for a re-vote on the $50.8 million budget that was defeated at Town Meeting on March 5. This new budgets cuts almost $2 million by removing a proposed $1 million contribution to the maintenance and reserve but, cutting 13 positions through attrition and deferring maintenance, continuing education and other one-time costs. Additionally, it reduces spending by factoring in 20% of the costs of currently vacant positions, saving another $400,000.

Tonight’s meeting follows an April 18 hybrid Zoom and person meeting that brought about a dozen people combined. During that meeting school district Lisa Estler explained the proposed budget and its tax ramifications. The new budget represents a 7.6% increase in spending, down from almost 12% in the March budget.

Based on state calculations for per pupil funding this new budget will raise taxes from 13.4% to 22% with the smallest tax increases in Duxbury and the largest in Warren due to each town’s Common Level of Appraisal. Here’s how that breaks down in terms of tax increases for each $100,000 of appraised value.

|

Adjusted Equalized Tax Rate of $1.4726 (Last Year of Reappraisal) |

Common Level of Appraisal |

Adjusted Equalized Tax Rate with CLA |

$ Change from Last Year |

% Change in Rate from Previous Year |

$ Change from Previous Year at $100,000 FMV |

|

Duxbury (2015) |

68.43% |

$2.1520 |

$0.25 |

13.40% |

$254 |

|

Fayston (2017) |

71.01% |

$2.0738 |

$0.29 |

16.20% |

$290 |

|

Moretown (2012) |

66.97% |

$2.1989 |

$0.26 |

13.70% |

$265 |

|

Waitsfield (2006) |

66.85% |

$2.2028 |

$0.39 |

21.80% |

$394 |

|

Warren (2012) |

61.30% |

$2.4023 |

$0.44 |

22.40% |

$439 |

|

Waterbury (2014) |

66.07% |

$2.2288 |

$0.32 |

17.00% |

$324 |

This slide, from the HUUSD April 18 information meeting about the upcoming April 30 vote on the revised, $48,888,319 budget shows the education tax increases for each town’s CLA and tax rate.

At the April 18 meeting Estler and district superintendent Dr. Mike Leichliter spent a lot of time explaining the intricacies of Vermont’s education funding system to folks new to the state and its taxation mechanism.

Michael Duell and Suzanne Lowen. Fayston, relocated to Vermont from Maryland. Duell asked why, if the budget is going up 7%, taxes are going up 13% to 22%. Leichliter explained the Brigham decision that created a statewide property taxation system essentially socializing the property wealth of all Vermont towns so that all students could have significantly equal education opportunity. That system and its per pupil grants are based on each town’s common level of appraisal which is a three-year average of town valuations compared to fair market value.

Towns are required to reappraise when their CLA falls below 85% or rises above 115%. During and after the pandemic, properties throughout the school district and the state were purchased at prices well above town appraisals, increasing fair market value and dropping CLAs. All local towns have CLA significantly below 85%. If CLA rates were equalized throughout the school districts, all towns would face the same percentage of increase in taxes, not due to the district’s proposed 7.6% increase, but due to the district’s obligation to help fund education in other parts of the state.

At last week’s meeting, Tom Glore, Waterbury asked the board how much total compensation for district employees had gone up over the past four years, specifically noting that people who don’t work in education have to pay for health insurance too.

He said that if the proposed budget passes, it becomes the baseline and added that if the budget passes, the board should not ignore the no voters.

Board member Ben Smith, via Zoom, told those present that he felt voting against the budget to send a message to Montpelier that the education funding system needs to be fix was not the right thing to do.

“But I feel like that message has already been given and state is scrambling to try and find a new system. We can keep knocking down that budget to make state hear us, but state has already heard us. At what point are we just flogging ourselves,” Smith said.

The board was asked about how district spending resulted in increases higher than those in the local budget and why the cost of education in Vermont was so high.

“In our district, we spend $1.6 million on pre-K education, which is one of things that leads to our higher costs. Other states don’t do that. We provide universal meals and guidance counselors and dual enrollment in high school and college. These are all things approved at a state level,” Leichliter explained.

This slide shows HUUSD workforce reductions through reductions that are part of the $48,888,319 budget that comes before voters on April 30. The entire budget presentation from an April 18 informational meeting can be found on the HUUSD.org website under the ‘board’ tab and then ‘agenda tab.

WHERE TO CAST BALLOTS

Polls will be open through the district next Tuesday, April 30 from 7:00 a.m to 7:00 p.m. at local town offices with exception of Waitsfield where voters will cast ballots at the Waitsfield United Church of Christ in the lower level Village Meeting House.

Voting is open now and taxpayers can cast early ballots at town clerks’ office until next Monday, April 29.